Forensic Accountant or Business Valuer? What’s the difference?

How does a Forensic Accountant with valuation expertise differ from a Business Valuer?

The field of forensic accounting, while niche, encompasses a broad range of skills sets. The ‘forensic’ part of the job relates to court work, therefore we are providing accounting expertise for potential use in a court.

Where it can get confusing is that some forensic accountants may claim experience in business valuations and while others don’t (eg they may choose to specialise in fraud investigation, insurance claims and/or solvency work). Further, not all business valuers are forensic accountants or accountants at all for that matter.

When is it appropriate to instruct a forensic accountant with valuation expertise to value a business?

This depends on the purpose of the business valuation!

The circumstances driving a need for a business valuation report can vary widely, but in simple terms, there are only one of three reasons why a business valuation report will be required:

1. For transaction purposes.

That is, you are looking to buy or sell a business. Some business brokers offer cheap valuation services. Be wary of experienced business brokers adopting industry rules of thumb to justify a price as the ‘price may not reflect value received’. ‘Registered Valuers’ are professionals in their own right, however they tend to specialise in the valuation of tangible assets e.g. property, plant and equipment. As many profitable businesses these days have a high component of intangible assets compared to tangible assets, business valuers with accounting and/or finance qualifications are likely to have better skill sets to identify and value intangible assets. Further, historically unprofitable businesses may have a significant value due to future profit potential as a result of development and investment in its intellectual property which supports it intangible asset value. Again, this is where business valuers with accounting and/or finance qualifications come into their own.

2. For compliance purposes.

Aside from meeting obligations under accounting standards, a business valuation report may be desired to demonstrate to a revenue authority (eg the ATO or state revenue office) that the values attributable between intangible assets has been allocated using acceptable market valuation principles and not for the purposes of obtaining a tax benefit. In other words, what portion of the total intangible asset value relates to brand, software, customer database, goodwill, etc? Many experienced business valuers with accounting and/or finance qualifications should be able to assist with this kind of business valuation.

3. For dispute purposes.

A valuation report may be required where owners of the business are in dispute with each other, a business owner is involved in divorce proceedings, the business is being compulsory acquired by a government authority and/or the business is involved in some other kind of commercial dispute (including a disputed will). This is where a forensic accountant with expertise in business valuations can be extremely useful.

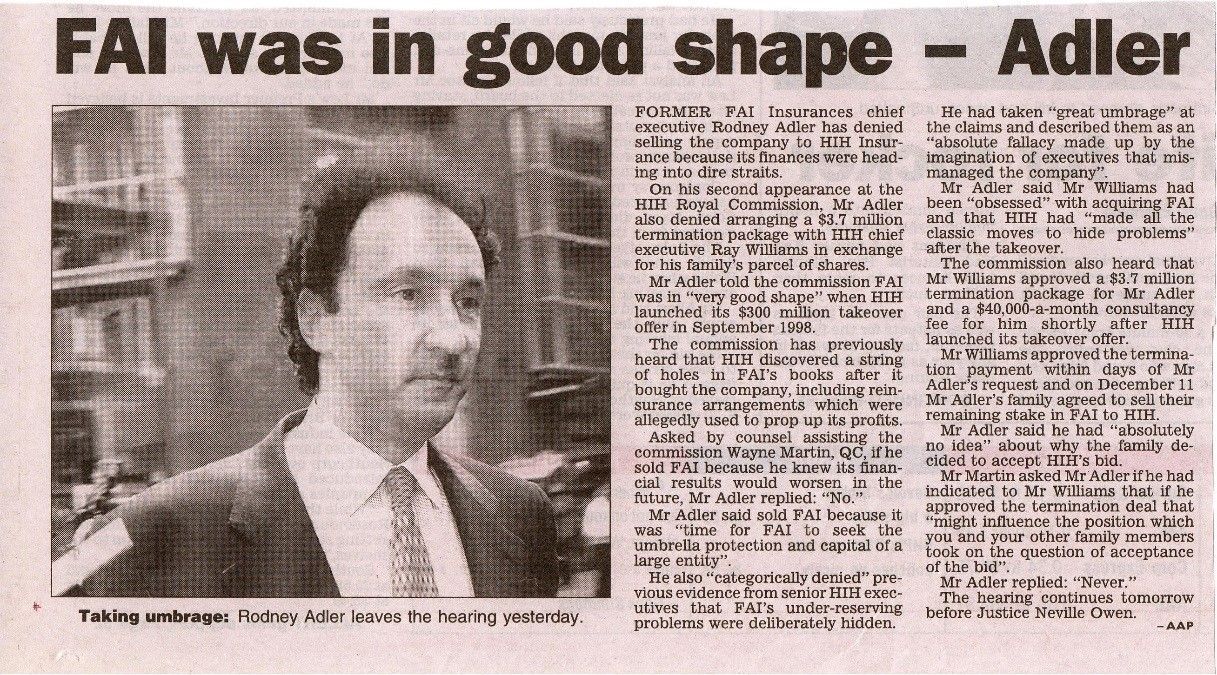

We are often called upon to review business valuation reports prepared by experienced business valuers, who may be selected by the client due to a particular industry-based focus. One of the common ways, to challenge the valuation opinions contained in these reports is by focusing on the assumptions adopted by the valuer. In other words, we apply a forensic approach to prove assumptions (as would be required in court) rather than accept assumptions (usually provided by the client).

A business valuer who regularly values business for transaction and/or compliance purposes will be accustomed to being provided with a number of assumptions by its client for the purposes of conducting the valuation. It usually makes commercial sense for the business valuer to not critically test and challenge assumptions if they appear reasonable on the surface. However, this is often not the case where valuations are prepared for dispute resolution purposes. The significantly higher level of scrutiny attached to a valuation report prepared for dispute purposes requires the business valuer to adopt the mindset of a forensic accountant.

Tips for lawyers

Disclaimers, caveats and limitations of work which are typically included in a valuation report often point to, on first read, unsupported but materially important assumptions which can result in the valuation opinion being highly discredited in machinations of the dispute process leading up to a potential trial. This is even before considering any significant differences in professional judgements adopted.

A forensic accountant, with genuine expertise in business valuation work, will prepare a well-supported, clear and unbiased report which should stand up to cross-examination in court. In some cases, a high-quality forensic accountant’s valuation report will avoid the need for the protagonists to go to trial. Unfortunately, we too often see how cheap business valuation reports prepared for dispute purposes end up costing the parties more over the course of the dispute.

If you need advice on the suitability of a particular business valuer for your matter, read more about our expertise and contact us.

Leave a Comment:

SEARCH ARTICLE:

SHARE POST:

RECENT ARTICLE: