Valuation Essentials For Family Lawyers

Lessons drawn from the May 2019 Family Law conference in the USA

In May 2019, the American Academy of Matrimonial Lawyers held its national conference (in Las Vegas) in what is akin to the biennial National Family Law Conference in Australia.

The American national event was attended by family lawyers as well as valuation professionals and forensic accountants.

Business Valuation Resources (BVR) sponsored the May 2019 American family law conference and reported on a number of interesting takeaways for attendees. I provide below 4 key takeaways, originally identified by BVR, which I consider are relevant to family lawyers in Australia:

Takeaway Point 1 “Cryptocurrency is easy to overlook, so you should specifically ask about it during the discovery process for a divorce case.”

I take this to mean that cryptocurrency is considered property and therefore a value needs to be assigned for family law purposes. Blockchain technology, particularly involving currency applications may provide the opportunity for some parties to ‘hide’ assets.

Takeaway Point 2 “Calculation engagements are a “dangerous and treacherous” area, but everyone seemed to agree that they have their place (except in court).”

In Australia, I am professionally bound by APES 225 – Valuation Services. I wholly agree that valuation reports which reflect the author expressing a conclusion based on a calculation engagement, as defined by APES 225 – Valuation Services, have no place in a family law matter[i].

Unfortunately, I have a valuation report on my desk prepared for a family law purpose and this person has written a 100-page report based on a calculation engagement. This report is a waste of money!

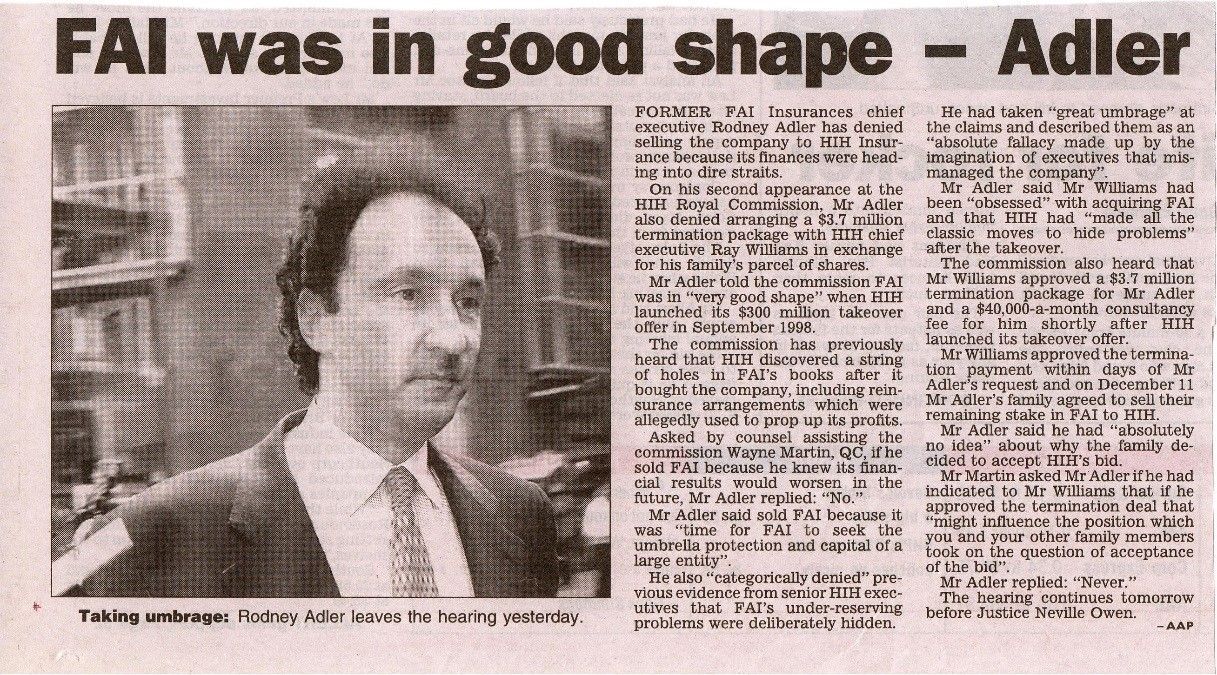

Takeaway Point 3 “Many attorneys underestimate the importance of going through an in-depth examination of an expert’s qualifications in court.”

Parties in a family law matter who are considering paying for valuation report to be relied on for a property settlement should only obtain a valuation report if it will be authored by a suitably qualified and experienced professional who has given admissible and credible expert evidence on valuation matters in court.

People preparing business valuations come from a broad church, but only some experts have given expert evidence in a court which was considered to be persuasive. The reality is that those people who haven’t been subject to the rigours of cross examination in court tend to prepare inferior quality valuation reports which do not promptly resolve the matter of contention and therefore costs the client more money in the long run.

Takeaway Point 4 “Valuing intellectual property is difficult and potentially expensive—and there’s a dearth of case law on how to value it.”

There are international valuation standards which provide authoritative guidance to valuation professionals in relation to the valuation on intangible assets, including intellectual property. While there are widely accepted valuation methodologies, case law cannot be ignored and legal context of the case law is important. For example, in December 2018, High Court of Australia issued a judgment in relation to a tax matter involving a multinational and internationally listed gold mining company where the Court unanimously decided that this company lacked any legal goodwill, notwithstanding that a Big 4 accounting firm valued the goodwill for accounting reporting purposes at $6.5 billion (in US dollars).

[i] There are three types of valuation engagements defined under APES 225 – Valuation Services, being a valuation engagement, a limited scope valuation engagement and calculation engagement. A valuation engagement is what should be prepared for a family law purpose. The definitions of a valuation engagement, a limited scope valuation engagement and a calculation engagement included in APES 225 – Valuation Services are included below:

Calculation Engagement means an Engagement or Assignment to perform a Valuation and provide a Valuation Report where the Member and the Client or Employer agree on the Valuation Approaches, Valuation Methods and Valuation Procedures the Member will employ. A Calculation Engagement generally does not include all of the Valuation Procedures required for a Valuation Engagement or a Limited Scope Valuation Engagement.

Limited Scope Valuation Engagement means an Engagement or Assignment to perform a Valuation and provide a Valuation Report where the scope of work is limited or restricted. The scope of work is limited or restricted where the Member is not free, as the Member would be but for the limitation or restriction, to employ the Valuation Approaches, Valuation Methods and Valuation Procedures that a reasonable and informed third party would perform taking into consideration all the specific facts and circumstances of the Engagement or Assignment available to the Member at that time, and it is reasonable to expect that the effect of the limitation or restriction on the estimate of value is material. A limitation or restriction may be imposed by the Client or Employer or it may arise from other sources or circumstances. A limitation or restriction may be present and known at the outset of the Engagement or Assignment or may arise or become known during the course of a Valuation Engagement. A Limited Scope Valuation Engagement may also be referred to as a “restricted-scope valuation engagement” or an “indicative valuation engagement”.

Valuation Engagement means an Engagement or Assignment to perform a Valuation and provide a Valuation Report where the Member is free to employ the Valuation Approaches, Valuation Methods, and Valuation Procedures that a reasonable and informed third party would perform taking into consideration all the specific facts and circumstances of the Engagement or Assignment available to the Member at that time. Where a Member has entered into a Valuation Engagement but during the course of performing the Valuation Engagement the Member becomes aware of a limitation or restriction that, if it had been known at the time the Engagement or Assignment was entered into, would have made the Engagement or Assignment a Limited Scope Valuation Engagement then the Valuation Engagement will become a Limited Scope Valuation Engagement.

This article first appeared in

Wolters Kluwer Central.

Leave a Comment:

SEARCH ARTICLE:

SHARE POST:

RECENT ARTICLE: