Loss of profits update in Class 3 NSWLEC proceedings

The Trustee for Whitcurt Unit Trust v Transport for NSW [2021] NSWLEC 82

On 30 July 2021, Pain J delivered her judgment in the above matter making it very plain that the nature and scope of the ‘interest in land’ are of fundamental importance for lawyers advising their clients on the quantum of compensation, including claims for loss of profit under the Land Acquisition (Just Terms) Compensation Act 1991 (NSW) (“Act”). The effective outcome for the applicant was that it received no compensation.

Background facts

The respondent compulsorily acquired a whole lot of land in Tempe (“Land”) on 20 March 2020, for a public purpose road project, involving improvements between the Sydney domestic and international airports (“Project”).

As at the date of compulsory acquisition of all the interests in Land:

- The applicant operated a golf coaching and golf driving range business from the Land (“Business”). The applicant’s Business commenced on or around 20 November 2017 which is the date of when the applicant acquired its leasehold interest in the Land. The applicant continued to operate its Business from the Land until 30 August 2020 when it was required to vacate the Land for the construction of the Project.

- The applicant occupied the Land under a ‘holding over’ clause as the lease period had expired which meant, under the terms of this lease, that the applicant’s leasehold interest in the Land was terminable with 2 month’s written notice.

- The critical assets required to operate the Business, such as the nets, lighting, turf, and other infrastructure were owned by the landlord (being a local council), not the applicant.

The respondent announced its intention to acquire the Land for the Project on 20 September 2018, which led the applicant to commence its search for alternative premises to relocate its Business, culminating in the applicant being invited to establish and operate a golf driving range on land in Campbelltown as a licensee, with a proposed 15+15 year term, in or around February 2019 (the license agreement was not executed by the applicant).

Applicant’s key submissions

The applicant claimed that it was entitled to relocate its Business to Campbelltown as it had demonstrated its intention to do so. The incurring of substantial fitout costs would be subject to receiving compensation, although some preliminary expenditure had already been incurred by the applicant.

Shortly before the respondent announcing its intention to acquire the Land for the Project, the applicant was in the process of securing a 5+5 year lease for use of the Land with its landlord. As a result of this announcement, long-term tenure for use of the Land was not secured by the applicant. But for the announcement, long-term tenure would have been secured for use of the Land.

Applicant’s claim for compensation

The applicant claimed compensation under the Act, totalling just over $4 million, comprising:

- legal costs and valuer’s fees of $118,381, under sections 59(1)(a) and 59(1)(b) of the Act (which were amounts not in dispute between the litigants);

- fitout and preliminary costs of $3,405,235, as ‘disturbance’ under section 59(1)(c) of the Act, or in the alternative as ‘market value’ under section 56(3) of the Act, or in the alternative as ‘special value’ under section 57 of the Act; and

- loss of profits of $498,384, as ‘disturbance’ under section 59(1)(c) of the Act, or in the alternative as ‘market value’ under section 56(3) of the Act, or in the alternative as ‘special value’ under section 57 of the Act.

Orders made

Compensation for ‘disturbance’ was awarded in the amount of $118,380.98 (for legal costs and valuer’s fees) only as all other compensation claims were dismissed.

Important findings

The nature and scope of the legal interest need to be assessed at the date of compulsory acquisition, as emphasised by the New South Wales Court of Appeal. The applicant’s claim that ‘but for’ test should be applied (i.e. the applicant would have secured a 5+5 year lease over the Land absent the announcement of the Project) is not a valid test as there is no case law supporting this construction of the Act.

The applicant submitted that the factual circumstances in this Whitcurt matter are similar to the facts in Hua v Hurstville City Council [2010] NSWLEC 61 which required the purchase of essential equipment for the business to continue at the proposed relocation site. Hua was also decided by Pain J, however, Her Honour considered the facts in Hua were distinguishable from the facts in this matter. In relation to the applicant’s claims for fit-out and preliminary costs of $3,405,235, as ‘disturbance’ under section 59(1)(c) of the Act, the following three tests in Director of Buildings and Lands v Shun Fung Ironworks Ltd [1995] 1 All ER 846 are (still) relevant:

- the claimant must genuinely intend to relocate;

- relocation must be practically possible; and

- relocation must be reasonable in the circumstances.

Her Honour found that the applicant’s claim for fit-out and preliminary costs of $3,405,235 as ‘disturbance’ under section 59(1)(c) of the Act was not reasonable having regard to the nature and scope of the leasehold interest (terminable with 2 months’ written notice). Her Honour was assisted by expert forensic accounting and valuation evidence on reasonableness in the context of a lack of legal ownership over the critical assets required to operate the Business and also the value of the Business, with and without a long-term tenure of the Land.

In relation to the applicant’s claims for fit-out and preliminary costs of $3,405,235, as ‘market value’ under section 56(3) of the Act, Her Honour reiterated the importance of her finding that the applicant’s leasehold interest was terminable with 2 months’ written notice and that represents the nature of what should be ‘reinstated’. Her Honour also considered if such a claim for reinstatement of the Business could be supported under section 56(3) of the Act (which was not on the facts), this amount would need to be reduced by the final limb under section 56(3) of the Act which is to reduce the amount by “any likely improvement in the owner’s financial position as a result of the relocation”. In that regard, Her Honour had regard to the proposed 15+15 year license agreement and expert evidence demonstrating the applicant’s Business had no value as at the date of acquisition (based on secure tenure in the Land for 2 months), but would have a value assuming the proposed 15+15 year license agreement had been entered.

In relation to the applicant’s claim for special value, being the “financial value of any advantage to the person entitled to compensation which is incidental to the person’s use of the land in addition to market value”, Her Honour considered that the applicant’s limited leasehold interest at the date of acquisition made it difficult for her to conceive there could be a claim for special value.

Currently unresolved issues in relation to ‘loss of profits’ claims

In this Whitcurt matter, Pain J found it was not reasonable to relocate or reinstate the Business and therefore the applicant’s claim for loss of profits of $498,384 was considered moot. That is, if there is no relocation or reinstatement of the Business, then the Business has stopped trading, so there can be no lost profit and therefore there is no claim for loss of profit under section 59(1)(c) of the Act.

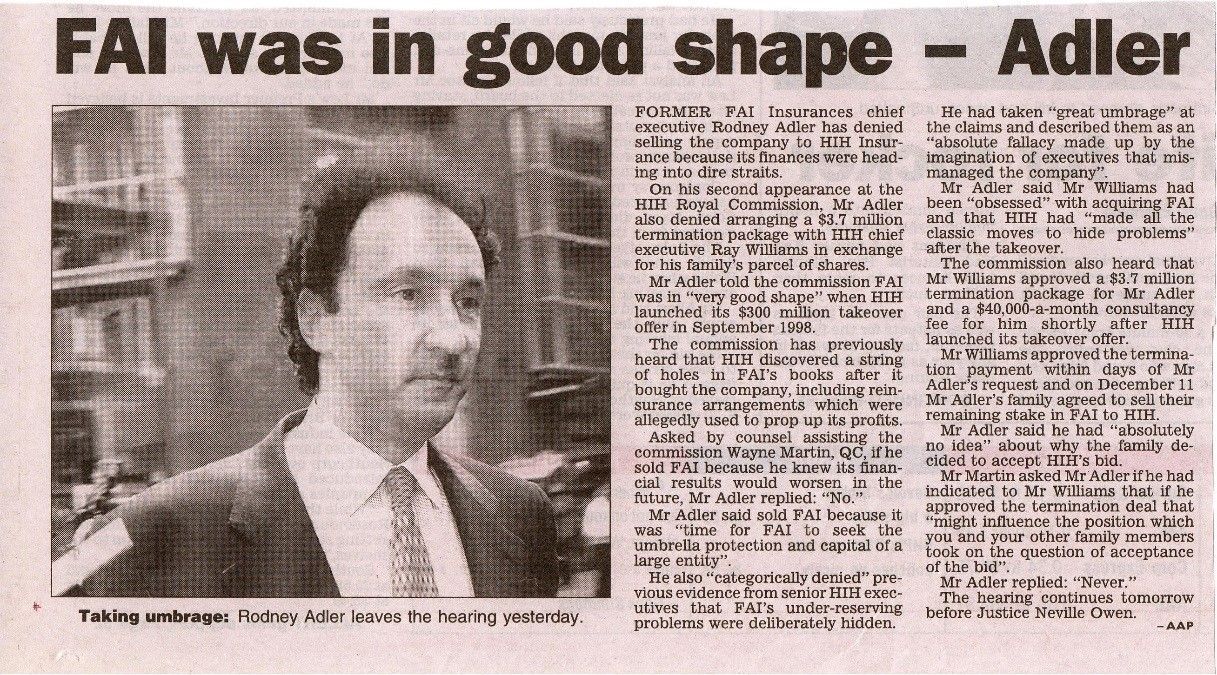

It is significant and relevant to highlight that two recent New South Wales Court of Appeal judgments have raised doubt as to whether the Act allows for claims for loss of profits at all, i.e. Alexandria Landfill Pty Ltd v Transport for NSW (2020) NSWCA 165 and Roads and Maritime Services v United Petroleum Pty Ltd (2019) NSWCA 41.

In matter of United Petroleum, the court of first instance held that there was no relocation of the business and compensation under section 59(1)(f) of the Act was awarded based on the extinguishment of the business – this comprised of a loss of profits into perpetuity[1]. The New South Wales Court of Appeal overturned this decision and held that the period of claim for loss of profit cannot exceed the remaining period in which the interest in land was held and made observations on the statutory construction of section 59(1)(f) of the Act which raised doubts on the validity of a claim for loss of profits under this part of the Act[2]. As the court of first instance held that there was no relocation of a business, the New South Wales Court of Appeal did not have to consider loss of profits in the context of a business relocation and left open a possibility to claim loss of profits under section 59(1)(c) of the Act.

In the matter of Alexandria Landfill, the New South Wales Court of Appeal considered its decision in United and also considered the meaning of the words ‘financial costs’ which appears in both sections 59(1)(c) and 59(1)(f) of the Act and suggested that their meanings in these respective parts of the Act should be the same[3].

Pain J did not directly address whether a claim for loss of profit:

- could be awarded under section 59(1)(c) of the Act, had Her Honour found a relocation of the Business was reasonable; and/or

- could be awarded under section 56(3) of the Act, as the applicant submitted during the final hearing (which was disputed by the respondent).

Curiously, in this Whitcurt matter, the applicant’s earlier submissions were no entitlement to compensation is available under section 59(1)(f) of the Act as a consequence of United, to which the respondent did not object. However, the applicant did submit that if the Court found that loss of profit could not be claimed under the other parts of the Act, the Court should award loss of profits under section 59(1)(f) of the Act, if the facts in this matter could be distinguished from the facts in United. Her Honour simply stated that the nature of the leasehold was such that a claim under section 59(1)(f) of the Act could not survive. The period of any loss of profits (e.g. 2 months) or appropriate measure of loss, (e.g. EBIT) was not contemplated due to the nature and scope of the leasehold interest.

Assuming that a claim for loss of profits could be compensable in a business relocation scenario, in Hua, Pain J set out 5 tests (posed as questions) for awarding disturbance compensation based on a business relocation being:

- Can the business be relocated?

- Do the applicant intend to relocate the business?

- Would a reasonable person relocate in the position of the applicant in the prevailing circumstances relocate the business?

- Is it feasible and practical to relocate within a reasonable timeframe?

- Will the relocation cost be less than the cost of extinguishment?

The above 5 questions are also found in a NSW government publication called “NSW Government Guidelines – Determination of compensation following the acquisition of a business“. This document is often directly referenced by valuers (some working for the Valuer General’s office) or the above questions are quoted without source in an expert valuer’s report dealing with disturbance compensation under the Act. It is arguable that the last test may not be appropriate, or is at least not a straightforward test and may be subject to further judicial interpretation given:

- the orbiter in United Petroleum and Alexandria Landfill which questions the validity of claiming loss of profits in a business extinguishment scenario;

- Pain J not awarding any compensation in this Whitcurt matter for an effective business extinguishment; and

- Pain J in this Whitcurt matter stating that section 59(1)(c) of the Act referring to “reasonably” incurred does not relate to the amount sought[4].

The current state of the law in relation to claims for compensation under the Act makes it ‘high risk’ for business interests to pursue claims for loss of profits. In this Whitcurt matter, the Valuer-General had determined compensation totalling $345,000 based on an assumed business extinguishment, which effectively put some money on the table for the applicant to accept. Ultimately, the Court awarded no money for the applicant which is likely a devastating blow for the applicant.

Loss of profits as a claim for compensation under the Act appears to be dead, but it is not buried. Sound legal advice from highly specialised and experienced lawyers familiar with the Act is a must, along with advice from quantum expert(s) who have an appreciation of the statutory framework. We do not provide legal advice and this article is for general information and educational awareness purposes only, based on its interpretation of the current state of the law on loss of profits as an item of compensation under the Act. However, check out our expertise in compulsory acquisition of land matters.

Leave a Comment:

SEARCH ARTICLE:

SHARE POST:

RECENT ARTICLE: